VAT rate adjustment

Contents

Introduction

Every report in TIM Enterprise can be fully customised, from how they perform their calculations to the way they appear.

To amend a report, you need to edit its associated XSL or PDF script file, paying attention to the class of web user whose content you want to change, and which report format.

This document details how to change the tax rate in the Phone Bill report in both Web and PDF formats, for any web user with a class of Administrator.

Every report has a unique ID number which the system uses to identify the report type (the report ID for a Phone Bill report is 2)

Changing Web format

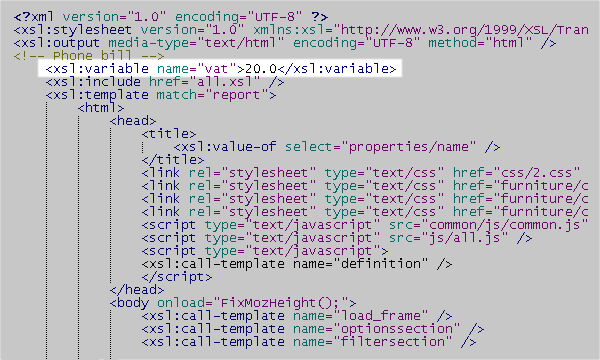

Open the following file in a plain text editor such as Notepad:

{Program Files}\Tri-Line\TIM Enterprise\ssldata\_admin\scripts\web\2.xsl

Look in the first few lines of code for the VAT amount, then change it to the new amount, respecting the decimal point and number of decimal places:

Save the file and run a new Phone Bill report in Web format to verify whether the amount has changed. If it hasn't then you may be running the report as a web user with a different web class than Administrator; in which case, modify the file in the path specified above, but choose the appropriate folder other than _admin.

Changing PDF format

Again, in a plain text editor such as Notepad, edit the following file:

You'll notice that this is a Javascript file, and that it is located in the \pdf\ folder of the \scripts\ folder.

{Program Files}\Tri-Line\TIM Enterprise\ssldata\_admin\scripts\pdf\2.js

Search for the following line (the value shown below may be different on your system):

var _vat = 20.0;

Change the value to the new amount, then save the file.

Run a new Phone Bill report in PDF format to verify that the amount has changed.